Is It Time To Get Back Into The (Wine) Market?

It has been done before, but I don't think it has been done quite as well nor made quite as accessible.

Vinfolio's new Fine Wine Index breaks down and measures wine as an investment vehicle. The on-line fine wine retailer and collector's services resource is able to do this by virtue of their ownership of The Wine Price Files (a tally of wine auction and retail prices of thousands of wines going back years) and their current monitoring of the fine wine auction market. What results is a vivid picture of the historic value of various categories of collectible wines.

The question is this: Who Cares?

The answer is this: The very small cadre of folks who use their love of wine as an investment vehicle.

Who should care? Anyone who lost their shirt since August 2008 as the securities market plunged.

Who else should care: Wine Geeks and Statistic Geeks.

Vinfolio's Fine Wine Index's tracks nine different sectors of the fine wine market including investment grade Port, Rhones, Burgundies, Australian wines, Californian Cults, Italian collectibles, Bordeaux First Growths, the 100 Top collectibles across regions and a broader list of 250 collectible wines from across various regions.

I won't look in depth into each Index that Vinfolio publishes. But it should be noted that they track the overall value of their index beginning in January 2005. Upon looking at the indexes, a few things become clear.

-Burgundies followed closely by Bordeaux clearly the best investment among regions.

-Port is the worst investment.

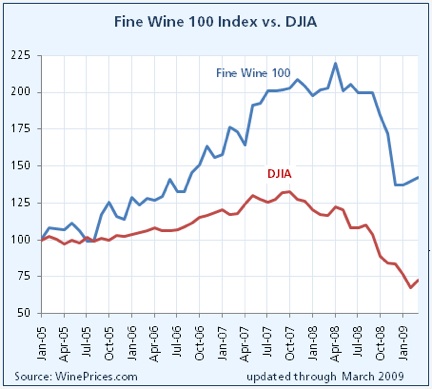

-In 2005 had you invested $1000 in any of the sectors of collectible wines tracked by Vinfolio's Fine Wine Index, you would be in a better position today than if you invested that same money in the securities that make up the Dow Jones Index.

-As an investment vehicle, blue chip wines are more volatile than blue chip stocks.

Again, there is a very limited number of investors for whom this information is important and useful. However, it's important to note that the key to creating a reliable market in any commodity is accessibility to information about that commodity. And although the Vinfolio Fine Wine Indexes track prices on a monthly rather than daily basis it is clear that if the information one needs to thoughtfully consider wine as an investment vehicle exists and is readily accessible. That's important.

Maybe I should be dumping my poorly performing mutual funds and investing in first growth Bordeaux. The problem would be the “liquidity” of these assets. Not whether I could sell them readily, but just hanging on to them without drinking them. 🙂

I hope the 2007 vintage port declaration and the consequent flooding of the market with more wine doesn’t lead to further drops of the port index.

Tom, thanks for the comments. Note that I just wrote a post on the Top 10 wine investments over the 2005-present period on my blog, The Wine Collector. 1982 Lafite was the top wine but it’s also interesting to see the even higher prices these wines fetched at their peak during this short period. Here’s the link for convenience: http://www.vinfolio.com/thewinecollector/2009/05/top-10-wine-investments-since.jsp