Report—Cannabis Impacting Wine and Alcohol Sales

Over the past week or so, Wine-Searcher’s W. Blake Gray has done a fantastic job of covering how Napa Valley’s powers that be are reacting to the cannabis marketplace. A little over a week ago Gray reported how Napa Valley is helping the California cannabis industry create its own AVA or appellation system for cannabis, while at the same time working to prevent a “Napa Valley” cannabis AVA. More recently, Gray covered the disagreement inside the Napa Valley wine industry over whether the cultivation of cannabis ought to be allowed in Napa County.

Over the past week or so, Wine-Searcher’s W. Blake Gray has done a fantastic job of covering how Napa Valley’s powers that be are reacting to the cannabis marketplace. A little over a week ago Gray reported how Napa Valley is helping the California cannabis industry create its own AVA or appellation system for cannabis, while at the same time working to prevent a “Napa Valley” cannabis AVA. More recently, Gray covered the disagreement inside the Napa Valley wine industry over whether the cultivation of cannabis ought to be allowed in Napa County.

Both articles are very informative. However, neither speak to the question, what impact is cannabis legalization and consumption having on wine and alcohol sales overall.

It should be no secret to readers that I’ve been among those who believe that legalized recreational cannabis will harm wine sales. I’ve not opposed cannabis legalization. In fact, I support it. And I’ve not suggested that the wine industry work to slow the adoption of cannabis. It couldn’t do so if it tried to anyway. However, I have questioned the wisdom of the wine industry working with the cannabis industry in ways that will advance its slow but sure intrusion into wine profits.

For the sake of this post, I want to draw attention to a recent report that confirms my earlier warnings that cannabis legalization will in fact harm wine and alcohol sales: The 2020 Cannabis Consumer Report, prepared by Spectacle Strategy and ICR and released last April.

Let me give you the money quote from the Report:

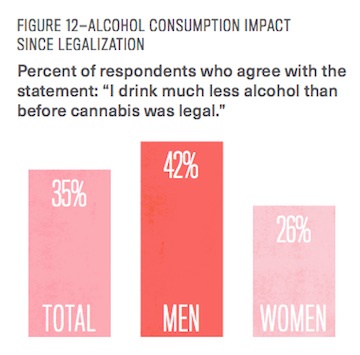

Of the consumers we surveyed, 35% indicate they “consume much less alcohol than before cannabis was legal,”… The impact appears to be affecting men more than women, with 42% and 26% citing reduced alcohol usage, respectively.”

Our research finds that, across demographics, cannabis users believe cannabis consumption to be less harmful to their health, with 84% of respondents believing cannabis is safer than alcohol.

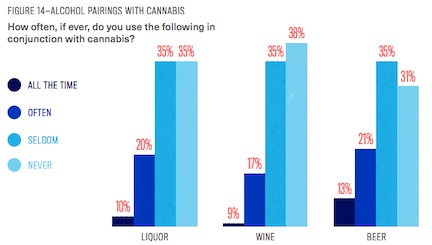

More than two-thirds of respondents to our survey report they “seldom or never use cannabis together with alcohol.”

What’s interesting about that last finding is that of beer, wine and spirits, it is wine that respondents said they are least likely to consume with cannabis.

The wine industry as a whole as a few headwinds to deal with. Tariffs impact wine sales and profits in the U.S. COVID is reducing wine’s ability to get in front of customers. Unusually  large and devastating fires are impacting America’s most important winegrowing regions and impacting wine production. Younger generations are drinking less alcohol. And, of course, there’s cannabis.

large and devastating fires are impacting America’s most important winegrowing regions and impacting wine production. Younger generations are drinking less alcohol. And, of course, there’s cannabis.

The little wine/cannabis dramas playing out in Napa Valley that Gray has been covering for Wine-Searcher are in fact just that—a “little drama” within a much bigger picture. But I’m not sure how it’s possible for the wine industry to ignore the fact that 35% INDICATE THEY CONSUME MUCH LESS ALCOHOL THAN BEFORE CANNABIS WAS LEGAL.

There is another thing to note about the 2020 Cannabis Consumer report. It’s respondents skew younger, with Millennials being a much larger percentage of the survey respondents than the actual population. Put another way, the largest number of those likely to consume less alcohol since cannabis became legal is the same demographic the wine industry is counting on to prop it up.

My argument is not that the wine industry will be buried by a switch to cannabis consumptions (although I’m absolutely positive cannabis consumption will slow the growth of wine consumption). Nor is my argument that the wine industry needs to do something about this, gosh darn it! My argument is that the wine industry reaching out to help the cannabis industry establish itself and even draw tourists to its production facilities and smoking rooms is a bad idea, no better in fact than the wine industry taking out ads suggesting that people drink more beer.

Didn’t anyone see this coming years ago?

Does anyone remember the vast amounts of money spent by big alcohol on the war on druga post Vietnam?