A Snapshot of the State of the Oregon Wine Industry

The ascent of the Oregon wine industry continues apace. The latest bit of evidence that Oregon wine (and Oregon Pinot Noir in particular) is one of the hottest wine categories in the United States comes in the form of the 2018 Oregon Vineyard and Winery Report, an annual report produced by the Oregon Wine Board.

The ascent of the Oregon wine industry continues apace. The latest bit of evidence that Oregon wine (and Oregon Pinot Noir in particular) is one of the hottest wine categories in the United States comes in the form of the 2018 Oregon Vineyard and Winery Report, an annual report produced by the Oregon Wine Board.

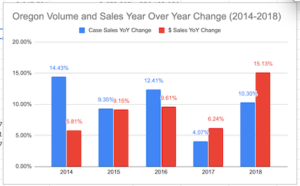

The highlights of the report, which is focused primarily on developing a snapshot of the industry in 2018, are primarily agriculture and production focused. However, the primary statistic from the report that identifies a booming industry is this: “2018 Case sales increased 15% from 3.60 million to 4.15 million, supported by increases in domestic sales outside of Oregon, direct to consumer channels and international sales.”

If you noticed that the channels cited above as contributing to that 15% increase in sales volume in 2018 are nearly every sales channel available to Oregon wineries, you’d be correct. The only sales channel not cited by the Report authors as an important contributor to the 15% year-over-year increase in volume sales is the Oregon-based FOB/Wholesale channel—sales of Oregon wines to Oregon based wholesalers and retailers for sale to Oregonians. FOB and wholesale sales of Oregon wine sold in Oregon retail and restaurant outlets increased 12% over 2017. That’s hefty, if not equal to the overall increase in sales of Oregon wine in 2018.

As I noted above, the Oregon Wine Board’s annual Vineyard and Winery Report represents a snapshot of the Oregon wine industry. The report is primarily a snapshot of the state of the vineyards in Oregon, including varietals planted, harvested and prices paid for grapes based on different geographic regions. Yet, since about 2005 the report has also included figures for sales of Oregon wine, including direct-to-consumer sales. Over time, the breakdown of sales of Oregon wine by channel in this report has become more robust. These are the figures that most interest me.

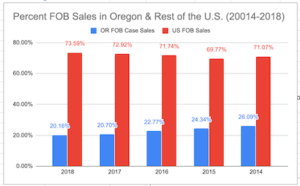

One indication of the recent increased interest in Oregon wine is the fact that over the past five years a  larger percentage of FOB/Wholesale sales have taken place outside of the state of Oregon. The chart on the right is derived from looking back at previous Vineyard and Winery Reports. Ever so slowly over the past five years, the percent of FOB/Wholesale sales of Oregon wine outside the state is increasing, while FOB/Wholesale sales inside the state of Oregon are slowly decreasing. This is a clear indication that consumers across the country have seen a continual increase in their exposure to Oregon wines while Oregon winery production has increased to meet new demand that can’t be accommodated within the state of Oregon where familiarity with the wines is greatest. This is a very positive trend.

larger percentage of FOB/Wholesale sales have taken place outside of the state of Oregon. The chart on the right is derived from looking back at previous Vineyard and Winery Reports. Ever so slowly over the past five years, the percent of FOB/Wholesale sales of Oregon wine outside the state is increasing, while FOB/Wholesale sales inside the state of Oregon are slowly decreasing. This is a clear indication that consumers across the country have seen a continual increase in their exposure to Oregon wines while Oregon winery production has increased to meet new demand that can’t be accommodated within the state of Oregon where familiarity with the wines is greatest. This is a very positive trend.

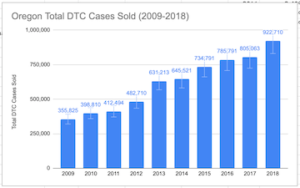

As for Direct-To-Consumer (DTC) sales of Oregon wines, the recent report shows that in 2018 Oregon wineries moved 922,710 cases out the winery door. This is a 160% increase from ten years ago and shows Oregon is poised to move 1 million cases of wine via the  DTC channel in 2019. Over the past five years, the Oregon Vineyard and Winery Report has broken down DTC sales into “Tasting room” sales, Wine Club sales, and Web/Phone sales. Furthermore, by looking at past reports it’s clear that the percentage of DTC sales for these three channels has remained fairly consistent over the past five years: 2018 Tasting Room Sales—62%, 2018 Wine Club Sales—29%, 2018 Web/Phone Sales—9%.

DTC channel in 2019. Over the past five years, the Oregon Vineyard and Winery Report has broken down DTC sales into “Tasting room” sales, Wine Club sales, and Web/Phone sales. Furthermore, by looking at past reports it’s clear that the percentage of DTC sales for these three channels has remained fairly consistent over the past five years: 2018 Tasting Room Sales—62%, 2018 Wine Club Sales—29%, 2018 Web/Phone Sales—9%.

The most current report also shows that Oregon’s 2018 DTC sales volume was up 14.6% over 2017. This 14.6% increase is significantly more than the 9.6% average increase over the previous nine years of DTC volume in Oregon. What’s not available via the report are the dollar sales for Oregon DTC sales. However, if we had those sales figures, I’d bet that the increase in value of DTC sales in 2018 would have been greater than the 14.6% increase in volume. The 2019 ShipCompliant/Wines & Vines Direct Shipping Report shows that the value of shipments from Oregon wineries in 2018 increased at a greater rate than the volume of shipments. Moreover, an greater increase in the value of Oregon DTC sales would be in line with the continued “premiumization” trend we’ve watched in the wine industry over the past few years.

The Oregon Wine Board’s annual Vineyard and Winery Report is certainly the best source of information on what’s happening on the ground in the Oregon wine industry, particularly on the ground where vines are planted. Unfortunately, its sales and marketing data is limited. That said, the data on DTC wine sales and FOB sales exists in different reports going back into the early 2000s.

Here is my plea to the Oregon Wine Board: Craft a report that shows the recent history (at least 10 years) of Oregon DTC and FOB/Wholesale sales volume. With the data that is currently published in each annual report, we can at least get a glimpse at how tasting room and other direct sales channels have evolved as Oregon’s profile within the consumer wine channel has increased. That report would be an invaluable historical document. Using past reports a third party could create this document on their own by sifting through past report and doing the right mathematical calculations to create consistent data over a period of a decade. But this is the kind of recap and the kind of historical document that really ought to come out of the Oregon Wine Board.

If you have an interest in the state of the Oregon wine industry, I highly recommend you download the short report. It has some fascinating information and statistics

Leave a Reply