Rodin, Pollock and Harlan: A Question of Value

Lest anyone ever forget that wine is art, just send them over to Vinfolio and their newly introduced "Wine Price File" service. No, I'm not reiterating that wine is a product that derives from the same creative impulses that drove Rodin, Pollock or Ben West. No. I'm reminded by Wine Price File that Wine is art in the sense that it collected, horded, traded, priced, bought and sold in the open market, just like the works of of these artists mentioned above.

When I was working at Winebid.com I saw just how serious collectors were about this art and I saw many different types of collectors. The most interesting collectors, as I look back on it now, were those who approached the stockpiling of wine not merely as an indication of their aesthetic disposition, but as a business. These were the folks who bought wine as an investment that involved short, medium and long term strategies.

Although they did not always know what their investments in first growth Bordeaux, Grand Cru Burgundy, Vintage Champagne, Vintage Port, the classic American Cabernets and the newly emerging Cult Wines were worth at any given time, they did know they were increasing in value. What was missing for them, as investors, was the same instant valuing process that Wall Street and security investors possessed.

Even though these folks were very astute about what they had squirreled away in temperature controlled locations, and even though they knew down to the penny what they paid for each and every bottle, they could not be entirely sure what it was worth at any given moment. The minute they submitted their list of collectibles to the likes of Winebid.com, Christies or other auction houses they'd find out.

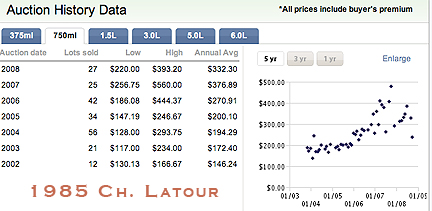

The beauty of Vinfolio's free Wine Price File is that the mystery for collectors as to what their wines are worth on the open market has been stripped away. There is no more mystery as to the value of a bottle of 1997 Harlan ($1180—up from about $700 three years ago), 1990 Bollinger Grande Annee ($131—up from about $89 three years ago), 1963 Croft Vintage Port ($124—up from about $90 three years ago) or 1985 Chateau Latour ($326—up from about $200 three years ago).

Wine Price File seems to be a final step toward complete and total transparency in the wine arena. Of course the information on what a wine was worth, what kind of price ascent it was on over the years and what was most recently paid for the wine was always available to one degree or another, but you had work at it or go to a specialist. That work and effort deterred many people from contemplating using their collection as an asset to be valued and potentially liquidated on the open market. Not any more.

Vinfolio does a great many things. Primarily it is the full service wine collectors emporium and hub driven by beautiful technology. Wine Price File is the topping off of those services. It will be used extensively not only by wine collectors, but by other other auction houses and collectors services companies as the instant and comprehensive wine valuation resource.

There is more to learn about the new Vinfolio Wine Price File with this press release and a great deal more to learn about the financial implications of wine collecting at Steve Bachmann's Wine Collector Blog. Finally, take a look at this story on one man's relationship with his own wine investments.

Tom, what I am curious about after reading this post is: What exactly did these folks drink on a day to day basis? Did they collect one region but drink another regularly? Did they even like to drink wine? I am sure each collector approached the actual consumption of their wine differently, but have you noticed any patterns?

Pretty nifty. According to the wine price file, my one bottle of 1941 Inglenook is worth an average of $8994. It appears to have appreciated quite a bit since I stole it 35 years ago. In case anyone’s interested, I’ll split the difference between today’s price and the price I acquired it.

Am I correct in thinking that the price is what the wines have been going for at the auction, and it is the price that you might expect, but not necessarily get? But It looks like an incredibly useful tool!

Is there something new that they added to enhance this? I thought this had been there for quite a while now.

Thanks for the shout out, Tom. sorry I missed the Blogger hoedown.

Tom,

This part of your post caught my eye:

“What was missing for them, as investors, was the same instant valuing process that Wall Street and security investors possessed.”

Transparency and price discovery–facilitated by services like this one–not only helps to reduce asymetric information in the market, but also provides a valuable repository for capturing historical pricing data.

This raw data, in turn, can be used to further the research in the area of wine investments, particularly as it relates to creating an efficient portfolio, diversified across multiple asset classes.

Historical correlation figures for wine versus other asset classes, stocks, for example, is somewhat limited in scope currently. Hopefully, this service will yield derivative benefits above and beyond it’s original goal.

J

spoken just like Greenspan, Dr. J…way to go!

What interests me is who they’re selling it to–do people buy from them to drink their portfolio, or is it other collectors with the hopes it will go even higher based on past trends?