The Uber-Wealthy’s Wine Industry

By all accounts the upper end of the wine industry in the United States ($25+ per bottle) is in full recovery from the retraction that occurred in 2008-2010.

-Retailers in metropolitan areas report much more robust sales

-Auction houses are seeing significantly increased activity

-High End Restaurants are seeing a return to conspicuous wine purchases

-Napa Valley has seen a recovery in its hospitality sector

Today, the New York Times reports that luxury goods are flying off the shelves across the country even without the aid of discounting. This return to conspicuous consumption, however, appears to be limited to the very wealthy who over the past year and a half have seen their portfolios buoyed by huge gains in the stock market.

To put it all in perspective, this is a pretty good time to be selling a $200 Napa Cabernet, a $100 Oregon or California Pinot Noir or a $75 Syrah that has the backing of a reputable third party reviewer. There are some people in the wine industry now who are getting very rich.

However, the question is what kind of wine industry will be created by a resurgence driven by the uber-wealthy's return to conspicuous consumption, but where the lower end of the market doesn't have the same kind of support.

Put another way, is there some sort of structural, systematic evolution that has and will continue to effect the wine industry? Consider:

• In 1970, top CEOs made 38 times more than the average worker. In 1988 they made 188 times more than the average worker. Today, top CEOs make more than a 1000 times more than the average worker.

• In 1950, the ratio of the average executive's paycheck to the average worker's paycheck was about 30 to 1. Since the year 2000, that ratio has exploded to between 300 to 500 to one

• The top 1% of U.S. earners control 34% of the wealth. The bottom 50% of U.S. earners control 2.5% of the wealth

• The top 1% of income earners own 50% of all stocks, bonds and mutual funds. The bottom 50% won .5% of all stocks, bonds and mutual funds.

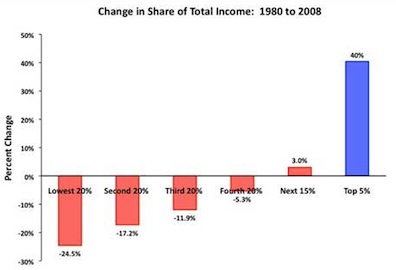

• Since 1979, the top 1% have seen their share of America's income more than double. The bottom 90% have seen their portion shrink.

Nice, concise, and on-point. This would make great editorial fare in main-line publications. Why is it that we continue to not want to tax uber-wealthy individuals and corporations??? I mean, if they could just pay the same percentage of income as we “normal” folks pay, life would be more fair and our treasury would benefit. Greed is, indeed, an ugly vice and this country is full of it. Thanks for a superb piece.

Really bad timing on this article. As reported many places:

“The Dow Jones industrial average dove more than 350 points, erasing its gains for the year.”

So much for the $200 cabs…

“Whether this gap is good for America or not is something that probably ought to be debated.”

I had to read that twice to be sure it said what I thought it said. This seems to me be one of those statements made by modern media writers intended to be “fair and balanced”, which is usually done when the opposite is called for. Objectivity does not require giving equal weight to utterly unequal arguments. Yeah, sure, there is no doubt someone ready and willing to take up the side that says the gap is indeed good for America, but these days there is no limit to the absurdities some folks will fight to defend.

Also, it is not axiomatic that a healthy top end can only exist if the rest of the range is lagging or diminished. In a good and balanced economy both would exist, be healthy, and in proportion. Unfortunately, the trend has been away from a well balanced economy for 30 years now.

Fortunately, true “in the glass” quality is not guaranteed by price, there are plenty of $200 dollar offerings that I would have no problem declining in favor of a knowledgeably selected $25 wine. A motivated consumer is not doomed to inferior wine if they can’t (or won’t) pay “aspirational” and/or often “irrational” prices.

Ned,

The point of the observation you point to was not added to be “fair” or “balanced”. The point was to acknowledge the critical importance of at least addressing the obvious, but more importantly to point the readers attention to the impact that income disparity might have on the wine industry.

I suppose I could write a political blog or a blog focused on economics. But I rather doubt I’d carry any authority on those issues.

Perry,

You may be right.

The DOW ended below 6,700 at its low in late 2008. Today the DOW is at 11,383.

Tom…

Mr. Crowley,

We have a progressive tax system… the wealthy pay the highest percentage of their income in income taxes. The lowest quintile pays the lowest percentage.

And yes, I’m talking about both marginal and effective rates. Nearly 50% of American households pay no federal income taxes, and the middle class pays the lowest Federal rates since 1955.

Tom,

Do you really think there are a lot of wineries getting rich? Most producers that I deal with that sell your typical $50+ Napa Cab are still struggling with the debt that they had to take on to get through the lean years. With potentially two short vintages in a row coming up, I wish I knew more folks who shared your optimism.

James,

I’m watching high end napa wineries rake it in right now and in a huge way compared to 2008 and 2009. Whether they have debt is another issue.

Tom,

That’s great news, I just wish I could see some data, as Silicon Valley reports only slightly improving profitability in high end wineries, even with the return of the upper tier.

It’s hard to imagine that not only are they much more profitable, they are getting very rich?

Mr. McCann the wealthy may pay the highest percentage of their income but only after they have reduced their taxable income by all of the loopholes at their disposal. What data supports your statement that 50% of American households pay no federal income tax? There is a huge gaping disparity between the upper and lower income brackets and the middle class is shrinking.

The Dow fell over 500 pts yesterday and lost all of the gains for the entire year in the past two weeks. Who is sweating this? Middle class Americans approaching retirement. They’ll be lucky to be able to drown their sorrows with a $15 bottle of wine. The wealthy can still enjoy a $200 Cab with a burger if they want. And I don’t think Tom was addressing the wineries’ debt from the lean years. He was referring to the money they are making on their high end, post 2008 financial crisis. Some of us middle class folk are still trying to recover from that.

Good piece Tom!

Lorie,

See below from the AP last year. The 47% number creeps up a bit each year. The top 10% in the U.S. pay 70% of income taxes. I can understand if people want that number to be even higher, but Bill’s statement was factually not only incorrect, it was not even in the ballpark. As for the middle class, they pay the lowest percentage of their income in taxes since approx. the mid 1950s.

What I took exception to was Tom’s statement that people in the wine industry were getting “very rich” selling high end wine. There are very few people who have EVER gotten very rich in the wine business, and their “fortunes” pale when compared to other industries. If they are having a good year, that’s one thing. But they are coming off at least two or three bad years, and many are facing short vintages in 2010 and 2011.

Stephen Ohlemacher, Associated Press Writer, On Wednesday April 7, 2010, 5:38 pm EDT

WASHINGTON (AP) — Tax Day is a dreaded deadline for millions, but for nearly half of U.S. households it’s simply somebody else’s problem.

About 47 percent will pay no federal income taxes at all for 2009.

Mr. McCann – the glib figure of the top 10% paying 70% of income taxes is less impressive when you consider that the top 10% of households in the U.S. own 80% of the wealth, and that payroll taxes are now roughly co-equal with income taxes in funding the government. That said, I share your skepticism of the notion of many people getting very rich in the high end wine business. The main way to do that seems to be finding someone with an even more inflated notion of the “riches” to be made.

Tom – I agree with your concern about the growing maldistribution of income and wealth in the U.S. But growth appears to be healthy across most price segments of the wine market, suggesting that the factors currently driving wine demand extend beyond income distribution.

Mr. Miller,

The 70% number is not glib, as the top 10% earn less than half of the income in this country, yet pay 70% of the taxes. As I said, I believe that reasonable people can argue that the upper income folks should pay even higher taxes. But please don’t confuse “wealth” with “income”; we tax “income”, except in the case of personal property taxes, where the wealthy certainly pay their share.

My point was to dispell the notion by one poster that the wealthy are somehow paying a lower percentage of their income in taxes than the rest of the country, which is not only false, it is the diametic opposite of the truth.

I wasn’t confusing wealth and income, just trying to offset the impression your 10/70 comparison might give as to the distribution of the tax burden in the country. I believe that the 10/70 figures would reflect the various deductions and modifications (cap gains for example) whose size and usefulness tends to rise with wealth and income. And not take into account the payroll tax burden which disproportionately impacts the middle class. But we’re wondering way off course here. I think we are probably more in accord on the economic prospects for expensive winery investments.

For an interesting postscript on this conversation, see Warren Buffett’s editorial in the NY Times today (Monday 8/15/11)