Is Wine Consumption Set to Decline in the U.S.?

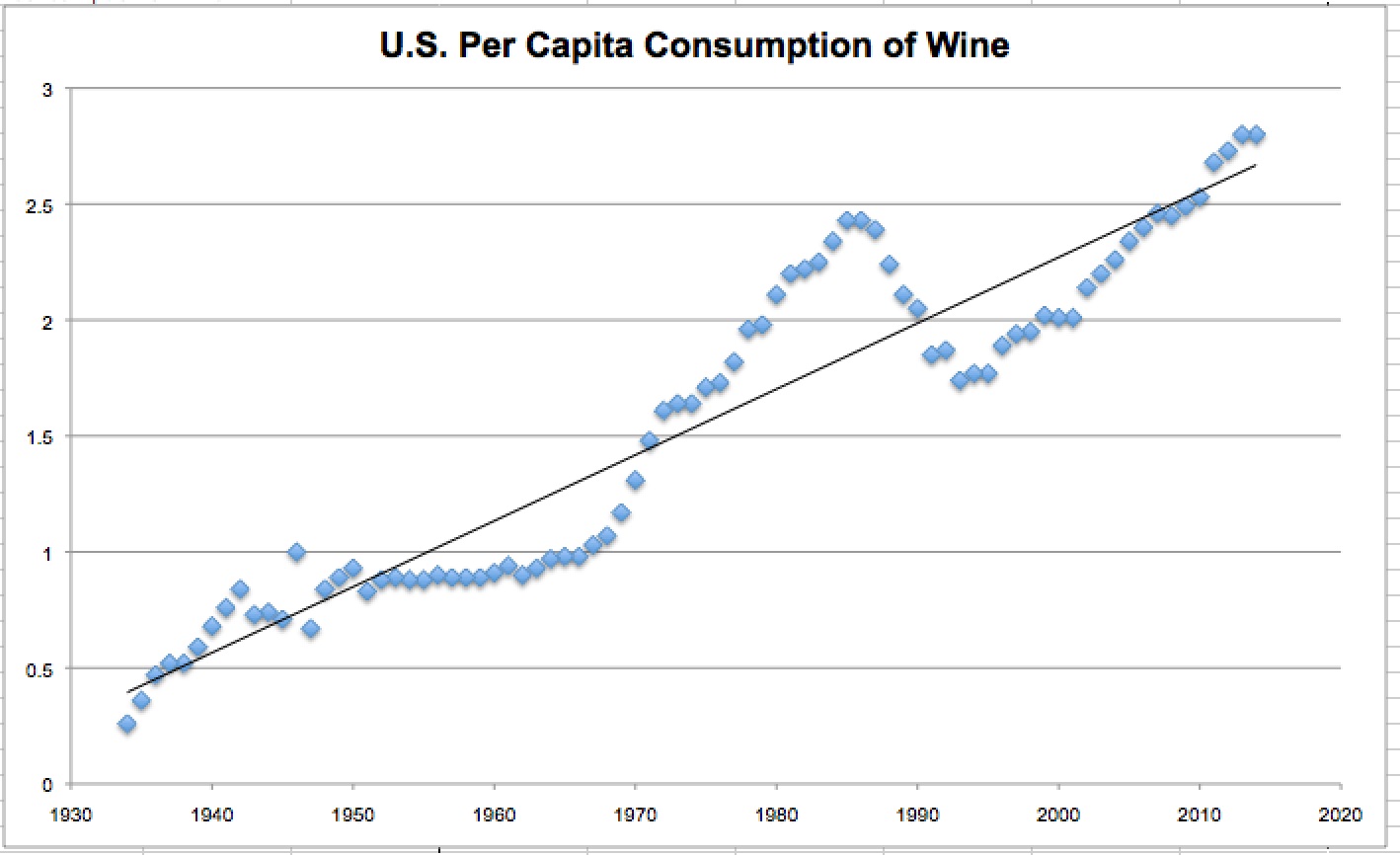

In 1965 per capita consumption of wine (PCCW) was flat from the year before. It neither grew nor decreased year over year It marked the moment when PCCW rates would go on a spectacular 18 year increase of 140%

In 1965 per capita consumption of wine (PCCW) was flat from the year before. It neither grew nor decreased year over year It marked the moment when PCCW rates would go on a spectacular 18 year increase of 140%

In 1986 the growth of PCCW was flat from the year before and would mark the year when PCCW decreased by 77% over the next 8 years.

In 1995 the growth of PCCW was flat from the year before and would mark the point when PCCW went on to rise 58% over the next 19 years.

During this last 19 year period PCCW fell 1% between 2007 and 2008 before continuing on to its 58% increase over 19 years.

In 2014 growth of PCCW was flat over 2013.

What I’m wondering is this: Will 2014 resemble 1986 or 2008?

Everyone working in and around the wine industry hopes is that 2014 was just another blip on the way to continued increases as was 2008. But if 2014 was 1986 it comes at an interesting time.

Currently the drivers of wine consumption, Baby Boomers, are rotating out of the drinking (and living) game and being replaced by the Millennial generation at the same time that the smaller Generation X is taking over the reigns of top wine consumers. It would be very nice to see the Millennials, with their large numbers, embrace wine the way their grandparents did. Such a phenomenon would ensure the continued health of the wine industry.

But much of what will impact Millennials future relationship with wine is in flux. Most importantly household income has been dropping over the past two or three years. Declining and increasing rates of household income correlate to the declines in PCCW in 1986 and the start of its increase in 1994. Declining household income means less disposable income and less disposable income means less spending on luxury goods—and wine is just that.

An additional factor that will impact how Millennials interact with wine going forward is the “Artisan Factor”. Millennials have been shown to be more attracted to products that are considered to be or said to be “artisan”, “handcrafted” or “handmade” than are members of previous generations. Beer, spirits and cider have all been identified as and actively marketed their products on the basis of their “artisan” or “craft” nature. Wine, not so much. Additionally, while it is pretty easy to find “craft beer” or “craft spirits” in those places people most commonly shop for food products, more often than not the wine aisles of these stores don’t stock the products of the smallest most “hands-on” wine producers. Sometimes its a matter of exposure.

We will know soon enough whether 2014’s flat PCCW was a one year blip or if we are witnessing the beginning of a decline in this crucial metric when 2015’s numbers are released. If 2015 does show a decline over 2014 the question then becomes are we looking at a real downward trend or will it be a relatively short decline before Millennials do the job of embracing wine even more fully than their grandparents?

Great minds, Tom. Declining wine sales are part of my 2016 trends post for next week. The numbers are even more revealing if you look at total sales for all wine in the U.S., which has been flat for two years while craft beer sales are up however many gazillions of percentage points.

From the above graph, it’s seen that the ‘overall trend’ is increasing with time. So I think we can trust the statistics and remain hopeful that wine consumption will keep rising.