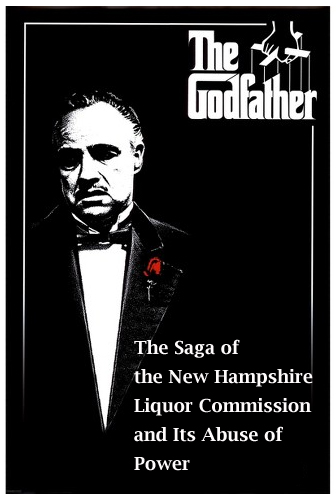

A Tale of Gangsters Taking Over Wine Regulation

Given the recent events in New Hampshire in which the Liquor Commission has begun to block wine shipments to the state’s consumers, it is becoming abundantly clear that the Liquor Commission there can’t be trusted to fairly administer its regulatory responsibilities concerning the direct shipment of wine. Furthermore, it’s clear now that the responsibility for overseeing the direct shipment of wine must be taken out of the hands of the New Hampshire Liquor Commission. When a state entity is responsible for regulating its competitors, it’s bound to fall into implementing gangster tactics and this is exactly what is happening in New Hampshire.

Given the recent events in New Hampshire in which the Liquor Commission has begun to block wine shipments to the state’s consumers, it is becoming abundantly clear that the Liquor Commission there can’t be trusted to fairly administer its regulatory responsibilities concerning the direct shipment of wine. Furthermore, it’s clear now that the responsibility for overseeing the direct shipment of wine must be taken out of the hands of the New Hampshire Liquor Commission. When a state entity is responsible for regulating its competitors, it’s bound to fall into implementing gangster tactics and this is exactly what is happening in New Hampshire.

New Hampshire is a “control state” where the Liquor Commission is responsible for both the wholesaling and retailing of wine. Yet, for years state law has explicitly allowed out-of-state wineries, retailers and wine-of-the-month clubs to obtain permits to ship wine to the state’s consumers. This ability to source wine from out-of-state sources has served as an important outlet for Granite State consumers who often can’t find rare, collectible and small production wines in the state stores. Out-of-state retailers have been of particular importance. Despite holding no more than 6% of the New Hampshire-issued direct wine shipping permits, retailers were responsible for 27% of sales of wine shipped to the state’s consumers in 2017.

In December, the Liquor Commission decided it didn’t want to compete with out-of-state fine wine retailers any more and authored a bill that would have stripped these out-of-state wine stores, auction houses, retailers and wine clubs of their right to obtain a wine shipping permit. That bill, SB 353, failed spectacularly. In February, the Senate Commerce Committee unanimously rejected it after hundreds of New Hampshire consumers wrote to Committee members and voiced their outrage. After the Commerce Committee rejected the bill, the entire Senate “tabled” SB 353, effectively killing it and the Commission’s plan to block all retailer wine shipments.

Yet in a spectacular usurpation of legislative authority, against the will of the state’s lawmakers, and in a complete abuse of power, the Liquor Commission began in February arbitrarily denying all applications for shipping permits from out-of-state wine retailers along with applications for renewal of shipping permits from out-of-state retailers and wine clubs that had been shipping legally for years. The Commission began doing what the state legislature told them they may not do.

This kind of abuse of power is exactly the kind of thing that can happen when a state that controls wine sales also regulates its competitors. The New Hampshire liquor commission begins to look like gangsters not willing to cede any territory. The “Gangster” analogy is particularly applicable when you consider that recently the Liquor Commission has come under fire for allegedly participating in bootlegging and money laundering schemes by selling huge amounts of liquor to out of state buyers who use cash to purchase the liquor, but break up their purchases so they come in just under the $10,000 threshold that would require the reporting of the transaction.

Bootlegging. Money Laundering. Aggressively Curtailing Competiton. Capone would be envious.

The Liquor Commission says they have the power to sanction out of state shippers if those shipments of wine are “diverting” revenue from the state. They claim that out of state retailers are selling and shipping wine to New Hampshire consumers that the Commission itself stocks and sells. Yet according to the Liquor Commission’s own testimony in front of lawmakers, the amount of wine shipped to New Hampshire consumers in 2017 amounted to less than one-half of one percent of the total revenues of Commision sales during the year. Moreover, the commission is denying shipping permits to new applicants for direct shipper permits who have yet to ship a single bottle of wine into New Hampshire, making it impossible to deny these applications on the basis that their shipments are “diverting revenue” from the state.

What is really going on is blackmail.

At this moment the New Hampshire Liquor Commission is attempting to push a new bill (HB 1626) that, in its amended form, would only allow retailer wine shipments from retailers in those states whose law allow shipments from out-of-state: a reciprocal policy. If successful this bill, it would cut off retailer wine shipments from stores and clubs in New York, Illinois, Florida, Texas, District of Columbia, Washington State—all but 13 states. It would severely reduce the access to wines that New Hampshire consumers currently enjoy.

The blackmail is simple: Either get on board with this new, much more restrictive retailer wine shipping law or we will deny all shipments into the state by retailers.

This isn’t the change in the law that the New Hampshire legislature should be considering. Instead, it should be considering and embracing a law that takes regulation of direct shipments out of the hands of the state Liquor Commission and places that responsibility with a body that isn’t competing with the out-of-state shippers. This is the only way to assure that gangster tactics are not employed against competitors. It’s the only way to assure real competition. And it’s the only way to assure an honest and well regulated free market in wine shipments.

___________________________

CROSS POSTED FROM WWW.NAWR.ORG

New Hampshire Liquor Commission may push any bill it desires, however, not a single law of New Hampshire will ever become a valid law in any other State.

Retailers outside of New Hampshire are regulated by their own States’ Liquor Commissions, that’s it.

Or, does New Hampshire Liquor Commission believe that it has any power to regulate Liquor Commissions of other States?

And again, Tom, the Direct Shipment is THE SHIPMENT from THE FEDERAL BASIC PERMIT HOLDER to CONSUMER. Please leave pure Tier-Three Retailers alone! They are off the federal and any other states jurisdictions. They are unquestionably licensed to sell ALL alcoholic beverages to ALL consumers over 21, no exceptions.

I don’t believe the District of Columbia will be negatively affected by the proposed new bill.

DC allows shipments from all comers.

VVP, can you please cite your authority for your following statement?

the Direct Shipment is THE SHIPMENT from THE FEDERAL BASIC PERMIT HOLDER to CONSUMER.

Wait a minute! Another state, another idiots?

New Hampshire Liquor Commission supposed to be an agency granted an authority by the state to regulate distribution and sale of alcohol inside of the state borders.

Where does it say that New Hampshire Liquor Commission is granted any authority to compete with Retailers outside of New Hampshire, or moreover regulate them?

@Tony Caffrey:

The TTB statement on Direct Shipping:

ttps://www.ttb.gov/publications/direct_shipping.shtml

and its Ruling 2000-1 which is remain active today

https://www.ttb.gov/rulings/2000-1.htm

Please notice the last paragraph in Ruling 2000-1. Federal agencies are powerless to regulate Retailers in their respective States. State Liquor Commissions aren’t permitted to regulate anything outside of their jurisdictions.

But!

Please notice that if a Retailer holds a retail license and a wholesale distributor license in the State simultaneously, such retailer automatically becomes a wholesale distributor in interstate commerce. He must obtain the Federal Basic Permit and may not sell (ship) any alcohol directly to consumers in all those States where holding of more then one tier license by the same person is prohibited without violation of those valid State laws.

Also, a State Attorney General, not the Liquor Commission must follow the procedure established by Congress in the same year of 2000 (https://www.ttb.gov/publications/21_amendment_enforcement.shtml) if a State AG has good reasons to believe that a person violates valid law of the State by shipping alcoholic beverage from another State to consumer in this state.

Any State law with express attempt to regulate licensee located outside of its jurisdiction is not a valid law, any major dude (Court) will tell you. 😉

@VVP

Four points:

1: Which states permit a licensed retailer to also hold a wholesaler’s license? That’s news to me.

2: Both ATF/TTB documents explicitly state that retailers are not required to obtain Federal Basic Permits.

3: Both docs also explicitly refer to “out of state sellers” and as with SCOTUS in Granholm, make zero distinction as between producers, wholesalers, and retailers.

4: Here’s the final sentence, (of the final graf), of ATF 2000-1 that you cite.

However, while ATF is vested with authority to regulate interstate commerce in alcoholic beverages pursuant to the FAA Act, the extent of this authority does not extend to situations where an out-of-State retailer is making the shipment into the State of the consumer.

@Tony Caffrey:

1. Ask Tom!. He knows what is the CA 17/20 type license.

2. These types (see above) of “retailers” are required to hold basic permit. Wineries also must hold retail license (to be a retailer) in order to sell directly to consumers, however, they also must hold basic permit.

3. Both docs explicitly except retailers without basic permit as “out of state sellers” from being regulated by federal agencies. Who else can regulate them besides those who licensed them?

Granholm didn’t distinct because it shouldn’t distinct, but distinction is:

PRODUCER can sell DIRECTLY to consumer only when allowed by State, but otherwise must sell only to wholesale distributor (or another producer).

WHOLESALER can’t sell anything DIRECTLY to consumer. His is licensed to sell for RESALE only. He can only resale either to RETAILER or to another WHOLESALE DISTRIBUTOR. (same applies to IMPORTER)

RETAILER is licensed to sell only to CONSUMERS. There is nothing left to bypass in order to sell DIRECTLY.

Retailer sale directly to consumer is absurd in the regulatory scheme where producer sells to wholesale distributor, wholesale distributor sells to retailer when consumer orders from retailer.

State of Indiana has the very clear answer why they would not allow California Wine Retailers (licensee type 17/20) to sell any wine directly to consumers in Indiana, despite it holds a retailer license. Possession of more than one tier license by the same person is not allowed by both Indiana and Federal laws. Any person who sells liquors at wholesale for resale is not a Retailer. (see WHOLESALER above)

While Indiana also has no power to regulate retailers in California it may use the “specific tool” provided by Congress (see previous communication) to restrain violators. 🙂

By the way, Illinois law also does not prohibit to out-of-state Retailers to sell and ship any liquors to consumer in Illinois for the same reason – it has no power to regulate them, but again, it does not prohibit only to Retailers. (see RETAILERS above)

(veux, veux-pas)

Read here you all. When I am licensed in my state to sell any booze to consumers and I am licensed to sell by any means, i.e. in person, by phone, mail or any other way of communications I am not required by my license to ask where a consumer is located in order to be able to sell him the booze he wants.

I am not aware that NHLC can lawfully require me to obtain any license to sell booze in my state even if I sell it to consumers from NH. I am not aware that NHLC can lawfully prohibit me to conduct my business in my state.

Special statement to NHLC, please deliver.

There is no state whose laws allow or disallow shipments from out-of-state in this country. States do not regulate interstate trade of alcohol.

@VVP.

This has turned out to be longer than I originally intended, so It’ll be my last on the issue, but please read to the end.

1: Ok, I’ve now read ShipCompliant on Ca 17/20’s. That’s an internal Ca matter, and of no relevance to retailers in other states as it relates to the NH situation.

Do you have any idea of raw and % numbers as to how many Ca 20 license holders, also hold 17 licenses? I suspect it’s a relatively small number of all ABC retailers, since grocery stores in Ca are I believe mostly 21″s.

2: Let’s forget about wineries, holding retail licenses in Ca, (they are unaffected by recent events in NH), and already covered by the 02 license, plus out of state permits.

The question I’d like answered is A: how many class 20 license holders, B: how many 17, and C: how many hold both?

3: You’ve mis-stated what the Federal ATF/TTB docs say.

You say: “Both docs explicitly except retailers without basic permit as “out of state sellers” from being regulated by federal agencies.” emph added..

implying that there’s a distinction between retailers with and without a basic permit.

The docs on the other hand make no distinction between retailers with and without a basic permit, because under federal law all retailers are exempt.

“Retailers are not required to obtain basic permits under the FAA Act.”

Notice they say “not required” as opposed to “prohibited”.

Federal law is a floor below which relevant licensees may not fall, but it is not a ceiling above which they may not rise, so long as it does not conflict with federal law, and Ca has provided an additional rung on the ladder, though I confess I’m not exactly sure why.

You say Granholm shouldn’t distinct, but that’s what SCOTUS does in almost every case. When it choses to make a distinction that’s an act of explicit commission, when it chooses not to make a distinction that can be interpreted as either and act of commission, or omission. That’s precisely why retailers are seeking clarification of Granholm. Was the lack of distinction omission or commission?

Your description of the wholesaler function is correct as I understood it, but Ca 20/17’s seem to be in conflict with that. Maybe 17/20’s should be abolished.

I’m a little confused by you Indiana and Illinois examples. You seem to be suggesting they achieve the same objective, preventing out of state retailers, but I read what you wrote differently. No biggie.

FYI: Several states, Delaware immediately comes to mind, but there are others too, explicitly permit their retailers to ship out, but prohibit out of state from shipping in. For them, alcohol crossing state lines is not the issue, it’s a revenue and regulation issue. The revenue issue can easily be dealt with by permits, which would make it more difficult for them to defend the regulation.

I think all of this will ultimately be moot, because of the 1947 GATT, since subsumed into the 1994 WTO.

The US is party to three complaints to the WTO about wine retailing in Canada. Two narrow ones against BC, and a broader and deeper one against Canada initiated by Australia. That’s the one to watch.

In all three complaints, unspecified general violations Article III, paragraph 4, of the GATT/WTO have been alleged.

The ironic thing is that because retailers are the only entities licensed to sell imported wine to consumers, the very same allegations can be made against the US with respect to it’s treatment of all imported alcohol, and I believe that is currently at least under consideration.

Here’s Article III, paragraph 4.

4. The products of the territory of any contracting party imported into the territory of any other contracting party shall be accorded treatment no less favourable than that accorded to like products of national origin in respect of all laws, regulations and requirements affecting their internal sale, offering for sale, purchase, transportation, distribution or use. The provisions of this paragraph shall not prevent the application of differential internal transportation charges which are based exclusively on the economic operation of the means of transport and not on the nationality of the product.

https://www.wto.org/english/res_e/booksp_e/gatt_ai_e/art3_e.pdf

Australia also invoked Article XXIV, Paragraph 12, against Canada and this I believe could equally apply to the US Federal Courts, because post Granholm, individual state laws are causing the US to be in violation of its WTO obligations.

12. Each contracting party shall take such reasonable measures as may be available to it to ensure observance of the provisions of this Agreement by the regional and local governments and authorities within its territories.

The bottom line here, I believe, is that the laws governing all alcohol sold in the US. must pass US constitutional muster, but imported product have the additional test of also passing WTO muster.

@VVP.

This has turned out to be longer than I intended, so It’ll be my last word on the issue, but please read to the end.

1: Ok, I’ve now read ShipCompliant on Ca 17/20’s. That’s an internal Ca matter, and of no relevance to retailers in other states as it relates to the NH situation.

Do you have any idea of raw and % numbers as to how many Ca 20 license holders, also hold 17 licenses? I suspect it’s a relatively small number of all ABC retailers, since grocery stores in Ca are I believe mostly 21″s.

2: Let’s forget about wineries, holding retail licenses in Ca, (they are unaffected by recent events in NH), and already covered by the 02 license, plus out of state permits.

The question I’d like answered is A: how many class 20 license holders, B: how many 17, and C: how many hold both?

3: You’ve mis-stated what the Federal ATF/TTB docs say.

You say: “Both docs explicitly except retailers without basic permit as “out of state sellers” from being regulated by federal agencies.” emph added..

implying that there’s a distinction between retailers with and without a basic permit.

The docs on the other hand make no distinction between retailers with and without a basic permit, because under federal law all retailers are exempt.

“Retailers are not required to obtain basic permits under the FAA Act.”

Notice they say “not required” as opposed to “prohibited”.

Federal law is a floor below which relevant licensees may not fall, but it is not a ceiling above which they may not rise, so long as it does not conflict with federal law, and Ca has provided an additional rung on the ladder, though I confess I’m not exactly sure why.

You say Granholm shouldn’t distinct, but that’s what SCOTUS does in almost every case. When it choses to make a distinction that’s an act of explicit commission, when it chooses not to make a distinction that can be interpreted as either and act of commission, or omission. That’s precisely why retailers are seeking clarification of Granholm. Was the lack of distinction omission or commission?

Your description of the wholesaler function is correct as I understood it, but Ca 20/17’s seem to be in conflict with that. Maybe 17/20’s should be abolished.

I’m a little confused by you Indiana and Illinois examples. You seem to be suggesting they achieve the same objective, preventing out of state retailers, but I read what you wrote differently. No biggie.

FYI: Several states, Delaware immediately comes to mind, but there are others too, explicitly permit their retailers to ship out, but prohibit out of state from shipping in. For them, alcohol crossing state lines is not the issue, it’s a revenue and regulation issue. The revenue issue can easily be dealt with by permits, which would make it more difficult for them to defend the regulation.

I think all of this will ultimately be moot, because of the 1947 GATT, since subsumed into the 1994 WTO.

The US is party to three complaints to the WTO about wine retailing in Canada. Two narrow ones against BC, and a broader and deeper one against Canada initiated by Australia. That’s the one to watch.

In all three complaints, unspecified general violations Article III, paragraph 4, of the GATT/WTO have been alleged.

The ironic thing is that because retailers are the only entities licensed to sell imported wine to consumers, the very same allegations can be made against the US with respect to it’s treatment of all imported alcohol, and I believe that is currently at least under consideration.

Here’s Article III, paragraph 4.

4. The products of the territory of any contracting party imported into the territory of any other contracting party shall be accorded treatment no less favourable than that accorded to like products of national origin in respect of all laws, regulations and requirements affecting their internal sale, offering for sale, purchase, transportation, distribution or use. The provisions of this paragraph shall not prevent the application of differential internal transportation charges which are based exclusively on the economic operation of the means of transport and not on the nationality of the product.

https://www.wto.org/english/res_e/booksp_e/gatt_ai_e/art3_e.pdf

Australia also invoked Article XXIV, Paragraph 12, against Canada and this I believe could equally apply to the US Federal Courts, because post Granholm, individual state laws are causing the US to be in violation of its WTO obligations.

12. Each contracting party shall take such reasonable measures as may be available to it to ensure observance of the provisions of this Agreement by the regional and local governments and authorities within its territories.

The bottom line here, I believe, is that the laws governing all alcohol sold in the US. must pass US constitutional muster, but imported product have the additional test of also passing WTO muster.

@Tony Caffrey:

Not far in the past, but in the year of 2000 States were able to understand that they are powerless to regulate situations with shipments of alcoholic beverages to consumers from sellers located outside the State, and were asking ATF for assistance.

ATF in the past and now TTB both are clear enough that they will not regulate situation where an out-of-State retailer is making the shipment into the State of the consumer, however, they will regulate the situation where a holder of federal basic permit does the same.

What else isn’t understandable here? What happened with certain States’ agencies, their legislatures and others that they have stopped understand this in 2018? Did alcohol become their very last source of revenue?

States can explicitly permit their retailers to ship out (their retailers are in their jurisdictions), but not a single State can prohibit anyone out-of-state from shipping in. Anything and anyone out of state is out of State jurisdiction.

As to Import and export of alcohol, it is also the Federal matter, not the States’ one!

BTW, Ship Compliant isn’t a trusted source at all.

And couple more words about NH Liquor Commission’s Section 178:27 Direct Shippers (https://www.nh.gov/liquor/enforcement/licensing/direct-shipping.htm):

Besides NH Liquor Commission is not authorized to require out-of-state producer importer, wholesaler, or retailer to apply for a direct shipper permit, which may put those entities in a situation where they will violate their home State laws (for example many states expressly prohibit their producers, importers and wholesalers to sell alcohol to consumers, and many states prohibit their retailers to sell alcohol to anyone licensed), NH Liquor Commission can’t even ask to obtain one while it is not required equally situated in-state businesses to obtain the same.

NH Liquor commission can’t lawfully collect 8% fee for each sale which is not consummated in NH. It may be lawful to collect federal excise tax and/or State liquor tax from a producer, but what NH Liquor Commission is trying to collect from a retailer who already prepaid all federal and state taxes to its home State? Can NH Liquor Commission explain its 8% fee for sale transaction not situated in NH?

The paragraph VIII of the NH Liquor Commission’s Section 178:27 is clearly in violation of a procedural due process required by The Twenty-First Amendment Enforcement Act.

In addition, under the Unauthorized Direct Shippers section of NH Liquor Commission website (same hyperlink above) there is a direct attempt by the State authority to regulate interstate carriers and interstate transportation, which is also far beyond NH Liquor Commission’s authority.

And finally about Dry voters. It is a big doubt that 100% of citizens in any city or town ever voted to go dry. While sales of alcohol may be limited or completely excluded in a city or town, it is totally private matter of those who voted “NO to Dry” to buy alcohol outside of Dry city or town limits and consume it on their own private properties.

The US citizens’ liberty yet is not repealed!